Deciphering Tax Appraisals for New Construction Homes

- By

- Kindred Homes

- Posted:

- February, 9, 2024

- Categories:

- General

Do New Construction Homes Appraise Higher & How Are Property Taxes Assessed On New Construction Homes

When buying a new construction home, it's important to understand tax appraisals. This affects your taxes now and also affects how much your property will be worth when you sell it. Let's answer common questions about tax appraisals for new homes and give you the information you need to make smart choices.

Key Definitions

Before we delve deeper, let's clarify a few essential terms that we will reference throughout this article:

Central Appraisal District (CAD): These are the professionals tasked with determining the value of properties within a specific jurisdiction. Their websites provide a wealth of property information. This includes tax appraisals, which is particularly helpful for individuals in the market for a new home. Listed below are the CAD sites of the geographic areas that Kindred sells in for easy reference.

Tax Assessed Value (TAV): This is essentially the official assessment of your home's value conducted by a certified professional. A crucial piece of information for various purposes, from taxation to securing a mortgage.

Comp: Short for comparable, these are properties similar to yours in location, size, and features. They serve as benchmarks for determining your home's value in the real estate market.

How Are Taxes Assessed on New Construction Homes?

The process of assessing taxes on new construction homes involves several factors:

On-Site Visits by Tax Assessors: Tax assessors conduct thorough inspections of new construction properties to evaluate their features and condition accurately.

Market Trends Analysis: Assessors analyze market trends and recent property sales data to gauge the value of new construction homes relative to comparable properties.

Consideration of Comps: Comparable properties play a pivotal role in determining the value of new construction homes. By comparing your property to similar ones in the area, assessors arrive at a fair and accurate appraisal.

Do New Construction Homes Appraise Higher

It's a common belief that new construction homes generally fetch higher appraisals due to their pristine condition. While this generally holds true, the local tax assessors can view a property to have lower or higher taxes than expected, due to a few key factors:

Lack of Comparable Properties: The availability of comparable properties, or lack thereof, can impact the appraisal process. Without adequate benchmarks, assessing the true value of a new construction home becomes challenging and in many cases, an element of guesswork will enter. Let’s take a look at a hypothetical example.

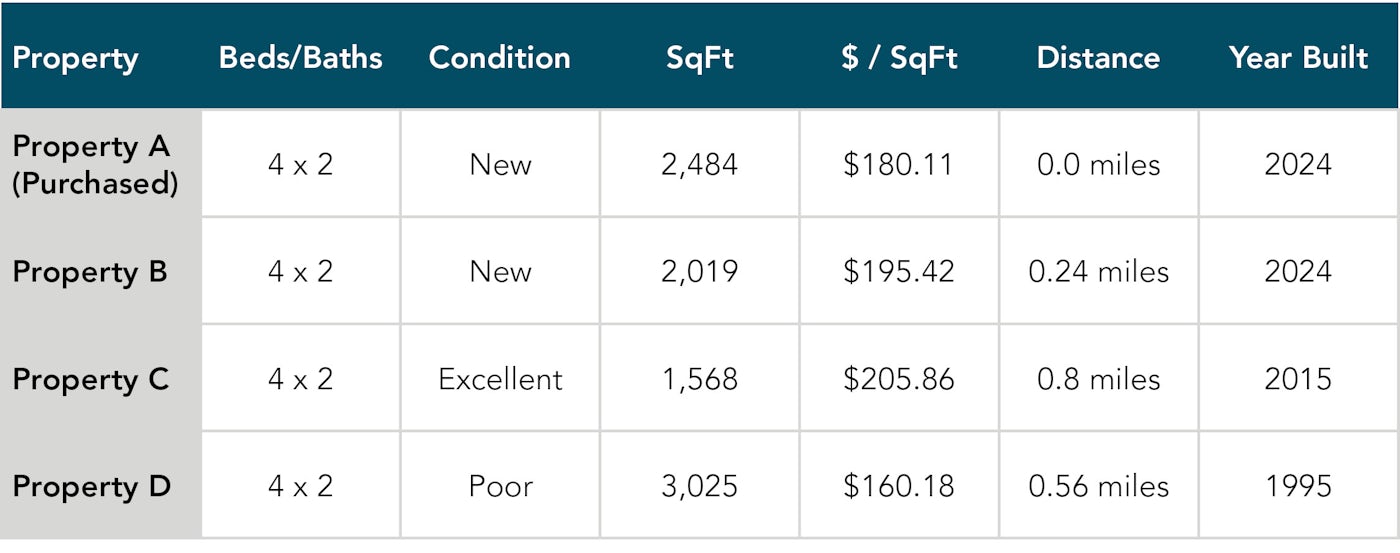

Suppose we have three properties outside of the property we are looking to purchase that are in a similar area:

These properties can be used as comparisons in this situation. They are close by and have similar bedrooms, bathrooms, and size. Some comps are more important than others. Property B is the most reliable comparison.

However, data from properties C and D can also be leveraged to provide supporting evidence. Consequently, it's reasonable to infer that the home you're considering purchasing is fairly priced, and the assessment is likely to align closely with market value, given the nature of neighboring properties.

Now suppose we are having difficulties finding comparable properties:

In this example, utilizing comparable properties poses a considerable challenge despite their apparent similarities. Given variations in bed/bath counts and distinct neighborhood locations, the appraisal process becomes notably intricate. Such discrepancies may result in a less precise assessment, potentially impacting the Taxable Assessed Value (TAV) either positively or negatively. This underscores the significance of having high-quality comps readily available. It's crucial to exercise caution when examining your own comps, as this example is intentionally simplistic and exaggerated for illustrative purposes. Nonetheless, it effectively underscores the importance of thorough assessment and due diligence in the appraisal process.

Market Fluctuations: Economic factors and market trends play a significant role in influencing appraisal values. For example, fluctuations in interest rates or sudden increases in demand can impact the appraisal process for your home. A notable instance occurred in 2021 when interest rates reached historic lows, resulting in a substantial rise in Taxable Assessed Values (TAVs) for many homes. But why did this happen? Well, with homes selling at higher prices, the price per square foot ($/SqFt) also increased, leading to higher appraisals overall. This phenomenon is driven by the principle of comparables, as discussed earlier.

Understanding tax appraisals for new construction homes is essential for any prospective homebuyer. By grasping the intricacies of the appraisal process and key considerations, you can navigate the real estate market with confidence. Whether you're eyeing a sleek modern abode or a charming suburban retreat, being informed about tax appraisals ensures that you make sound financial decisions. So, arm yourself with knowledge, leverage available resources like CAD websites, and embark on your home-buying journey with clarity and confidence.

Articles Referenced:

House Bouse Article - How Are Property Taxes Assessed On A New Construction Home? (housebouse.com)

Cohesive Homes Article - Do New Construction Homes Appraise Higher? An In-Depth Guide On New Construction Home Appraisal! - Cohesive Homes